In order to sell a company at a fair price, a pre-sale preparation is required. This process is more extensive for the seller than for the buyer.

For the seller, the pre-sale preparation consists of the following:

- pre-sale inspection of the company (the seller’s due diligence);

- pre-sale tax consultations;

- reorganisation of the company, if necessary (division, merger, etc.);

- preparation of materials for the buyer (The Information Memorandum).

For the buyer, pre-purchase preparation includes only due diligence.

Pre-sale inspection (due diligence)

We recommend that you check the financial and tax risks of the company to be acquired before purchasing it. To do this, you need to order due diligence of the company to be acquired. The results of due diligence influence the sale price of the company, as they result in a final decision on the purchase of the company.

With more than twenty years of experience in carrying out financial and tax due diligence for companies in various spheres (machining, logistics, real estate, and catering companies), we are perfectly positioned to help the seller to better prepare for the purchase and sale transaction by conducting due diligence on the seller’s part.

We help the buyer to determine the financial and tax risks of the company to be acquired.

We provide both financial and tax due diligence. Our partners are successful law firms (Ellex Raidla Advokaadibüroo OÜ, Advokaadibüroo Cobalt OÜ, and others) on whose order we have performed special audits, as well as tax and financial due diligence in various companies.

Pre-sale inspection of the company for the seller (the seller’s due diligence)

In order to achieve the maximum sales price in the sales process, it is useful to review the company’s business structure and financial statements (the seller’s due diligence) before the sale. Audits include financial statements, financial indicators, and tax accounting. As a result, a report is prepared on the basis of which the company’s management board can make the necessary adjustments and/or corrections to the company’s structure and/or accounts. We help to make the necessary corrections and adjustments.

If during the audit it turns out that it is useful to re-organise the company to achieve the maximum sales price, we will also help with this procedure.

The company’s pre-sale audit gives the seller a forecast of the future transaction, which helps them to better prepare for the sale and plan cash flows.

Pre-sale tax consultation

There is a constant sale of companies taking place in the Republic of Estonia. In the event of the sale of a company, the question of what is being sold in the first place – whether the company’s assets, shares, participation, company or legal entity, etc., – become relevant.

Consequently, it is reasonable to order a pre-sale consultation. We provide tax advice to companies that are for sale and analyse the tax structure of a potential future transaction and inform about possible risks, referring to the tax consequences of the transaction.

The practice of Finantskonsultant involves a number of pre-sales tax consultations with different structures.

Re-organisation of the company

Usually, the need to re-organise a company arises for those companies that have been engaged in various business activities for years and/or before the company was put up for sale.

Many companies also need to re-organise their structures in order to gain better synergies and an overview of cost savings and/or financial performance. In addition, it may be necessary to separate a part of the company that may give rise to a new business.

Changes in the structure of the company can take place through:

- division of a company;

- merger of a company;

- sales of a department;

- other in-house changes.

We help to develop the necessary business structure based on the company’s financial goal. We also help when it comes to making agreed re-organisations. Based on the previously approved change in the structure, we perform all the necessary procedures from the preparation of the documentation to the recording of the re-organisation in the commercial register. We also help the company’s accountant to reflect the re-organisation in the company’s financial statements.

We have more than twenty years of experience in the financial field and are the right partners to advise on corporate re-organisation issues.

Division of company

The division of a company comes up when the company plans to sell part of its activities. There are different ways and a set of rules for the process to follow. We help with the process from start to finish and perform all the necessary procedures from the preparation of the documentation to the recording of the re-organisation in the commercial register. We also help the company’s accountant to reflect the division of the company in the financial statements.

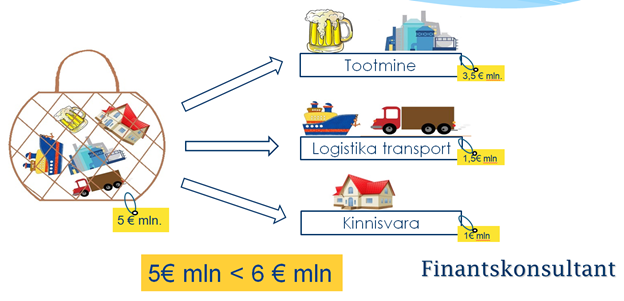

Example: When a company is engaged in production, it usually has both real estate owned by the company and the transport needed for production. In this case, it is reasonable to divide the company into three, as these three separate companies can be sold at a higher price after the division than the one company before the division.

For example, a separate unit engaged in production and transport may be sold and passive income from the real estate business may continue.

The main difference is that after the spin-off, the company continues to operate, but after the division, it ceases to exist.

It is useful to make a division of the company before the sale, as usually the prospective buyer is interested in only one activity of the company. If the company is engaged in several different types of activities, it is necessary to select them. Contact us if you are interested!

Merger of company

The merger of a company is a common practice in today’s economy. If the owner has several companies with a similar activity and/or business purpose, it is reasonable to consider a merger. The financial and tax risks associated with a merger should never be underestimated and they require a thorough analysis.

This process can contribute to restructuring of companies and lead to significant cost savings in both management and remuneration issues. The merger of a company will also bring additional opportunities to increase the market and make investments. Consequently, mergers are a particularly necessary operation for emerging companies.

The merger process is relatively time consuming (minimum three months) and complicated, but its end result should contribute to better financial decisions in the future.

Preparation of materials by the seller for the buyer (The Information Memorandum)

The sale of a business is the process by which the owner sells their stake to a potential investor. If the seller’s name is not immediately recommended in the reference materials, this is called The Information Memorandum.

The Information Memorandum of the company must show the company to the potential buyer in the best light, giving a realistic view of what is being sold.

The length and complexity of the memorandum depends on the size of the company and the amount by which the company is planned to be sold. Experience has indicated that a higher selling price requires a more precise and positive memorandum that is not overestimated.

The memorandum seeks to draw the potential buyer’s attention to the pros of the transaction, while also highlighting the possible disadvantages.

Pre-purchase analysis of the company for the buyer/investor, or due diligence

In order to ensure that the purchase of a company does not involve blind action, the pre-purchase analysis of the company, or the internationally known term due diligence (DD), comes to the fore. During the pre-purchase analysis, the buyer can obtain comprehensive information about the company’s activities and check the accuracy of the information provided by the seller.

Due diligence is a procedure in which an independent financial, tax, and legal audit is performed to provide an objective overview of the company and to identify potential risks in the business. The risks identified as a result of the process affect the price of the future transaction and provide advice to the buyer on the basis of which a final decision can be made with regard to the purchase of the company.

Due Diligence consists of three parts and a written report shall be drawn up:

- financial audit (FDD);

- tax audit (TDD);

- legal audit (LDD).

Finantskonsultant carries out two of the three inspections mentioned above, namely financial audit (FDD) and tax audit (TDD). The third, or legal audit (LDD) is performed by our cooperation partners.

Financial due diligence (FDD)

The company’s financial risks are checked during financial audits (FDD). FDD answers questions about whether the financial statements submitted by the seller correspond to the actual condition of the company and the supporting documents.

Tax due diligence (TDD)

A company’s historical tax risks are checked during a tax audit (TDD) by reviewing contracts and tax returns from the previous period and identifying transactions that were not declared. They may give rise to future tax risks if they involve non-business transactions, related parties, undeclared wage payments or special benefits, etc.

The amounts of tax risk and transactions found give the person purchasing the company the opportunity to adjust the sales price and/or demand additional guarantees.

The practice of Finantskonsultant includes pre-purchase financial and tax due diligence of production companies, due diligence of a metal production company, etc.